From Page to Practice: Behaving ‘Predictably Irrational’ in an Unpredictable Economy

As part of our "From Page to Practice" series, we're exploring the practical uses of behavioural economics principles outlined in Dan Ariely's groundbreaking book, "Predictably Irrational." With a focus on the unpredictable global economy, this article delves into how both consumers and businesses make economic decisions despite the systematic biases that can lead to seemingly irrational choices.

A bull in a china shop. That's what the global economy has resembled over the last 2-3 years - volatile, unpredictable, and capable of making a mess with just one wrong move. The world of commerce has transformed into an intricate maze, where every twist and turn brings novel challenges. The past three years have seen this maze evolve from mere complexity into a veritable Gordian Knot of volatility, and for those within it, guidance is needed more than ever.

The field of traditional economics, which heavily relies on the concept of rational choice, often struggles to make sense of complex situations. However, the solution to this might not lie solely in data analysis or market research. Rather, it could come from a deeper understanding of human behaviour, as explained by behavioural economist Dan Ariely in his influential work, "Predictably Irrational." By recognizing and exploring the peculiarities of human nature, we can better navigate the unpredictable landscape of the modern economy.

Main Economic Themes and Insights from Predictably Irrational

At the heart of Dan Ariely's groundbreaking work "Predictably Irrational" is the exploration of the invisible forces that guide human decision-making. Through fascinating research and compelling narratives, Ariely reveals that our decisions, economic or otherwise, are less rooted in rational thinking and more influenced by hidden impulses and biases, making our behaviour predictably irrational.

"Our irrational behaviors are neither random nor senseless—they are systematic and predictable. We all make the same types of mistakes over and over, because of the basic wiring of our brains."

- Dan Ariely, Predictably Irrational

While the book offers a vast landscape of insights into various aspects of human behaviour, our focus in this article will narrow down to the complex dynamics of pricing. Ariely's work brings to light how our understanding of price and value is not merely a matter of numbers but a cognitive process skewed by certain irrational behaviours. For our present purpose, we will delve into three of these influential factors - the power of 'free,' the influence of relativity, and the effect of expectations - offering a novel perspective to navigate our contemporary volatile economy.

The Power of Free

Every labyrinth has its lures and traps, and in Ariely's economic maze, the most beguiling of all are marked with the sign of 'free.' This enchanting spell, echoing the siren call of an oasis in a desert, has been rigorously examined through a lens of behavioural economics. This phenomenon, aptly termed the "zero price effect," is often irresistible to the weary traveller. Yet, as Ariely's empirical evidence illuminates, this route is fraught with hidden perils.

One of Ariely's most illustrative studies involved two kinds of chocolate: Hershey's Kisses and Lindor truffles. He offered the chocolates at a heavily discounted rate: the Kisses for free and the truffles for a mere penny. Astonishingly, consumers overwhelmingly chose the free Kisses, even when the Lindor truffles, known for their superior quality, were nearly as inexpensive. This demonstrated our preference for 'free' items over those with a marginal cost, and the ability of 'free' to lead us astray, into decisions that may not serve our best interests.

This predisposition extends beyond the realm of confectionery. We willingly queue for free ice cream, even if the time we lose standing in line far outweighs the monetary value of the dessert itself. Likewise, we're enticed by the allure of free shipping, often buying more than we intended just to reach the qualifying threshold. As consumers, recognizing this irrational penchant for 'free' is the first step towards making smarter, more effective economic decisions, rather than getting lost in the labyrinth of illusory 'free' choices.

The Influence of Relativity

In the labyrinth of economic decisions, we seldom assess each path independently. Instead, we are influenced by the signposts of relativity. Rather than considering the absolute value of each option, we compare them against each other. This principle explains why we'd follow a path promising a $500 saving, even if it's longer than the one we initially intended to traverse. Even when faced with the option of a cheaper and more expedient route, we are swayed by the seductive power of a discount.

"We not only tend to compare things with one another but also tend to focus on comparing things that are easily comparable—and avoid comparing things that cannot be compared easily."

- Dan Ariely, Predictably Irrational

Ariely's exploration of this relative nature of our decision-making process is a key concept for both consumers aiming to make savvy purchasing decisions and businesses striving to position their products effectively.

The Effect of Expectations

Our expectations of the quality of a bottle of wine have more to do with its price than with its taste.

"When we believe beforehand that something will be good, therefore, it generally will be good—and when we think it will be bad, it will be bad."

- Dan Ariely, Predictably Irrational

Ariely's final concept highlights the impact of expectations on navigating the economic maze. Like a map of a treasure-filled labyrinth passed down through generations, our expectations guide our decisions and perceptions. In the world of commerce, if a wine is labelled as expensive, we're likely to perceive it as tasting better than a cheaper alternative, irrespective of the actual quality. These preconceived notions play a massive role in shaping consumer behaviour, making it an essential consideration for businesses aiming to successfully market their products.

New Applications for Current Economic Conditions

As we stand at the threshold of the labyrinth, armed with Ariely's insights, we must consider how to apply them within the modern economic context. Let's delve into how the allure of 'free,' the concept of relativity, and the power of expectations can be harnessed to guide us through today's volatile economic corridors.

Re-evaluating the Power of Free

In the technicolour spectrum of the modern tech economy, 'free' can sometimes feel like a fading hue. Yet, even as we question its viability, particularly within SaaS platforms, the magnetism of 'free' can still play a central role in a business’s revenue model when employed astutely. The trick lies in the paradox of redefining 'free' to drive monetization.

Take the SaaS landscape, where user acquisition is vital. Here, a freemium model serves as an entryway into the labyrinth, attracting users with its 'free' tag. However, the challenge for SaaS businesses is to convert these free users into paying customers. An innovative way of doing this is through a "value-added" model. The free users gain access to basic features, while the more sophisticated or enhanced features, which offer additional value, come with a price tag.

LinkedIn, for instance, offers free networking and job search functionalities, but premium features such as advanced search, InMail, and online training courses are behind a paywall. Even within the free tier, LinkedIn has found ways to monetize, offering one-time feature unlocks (e.g., a month of premium or a single InMail) in exchange for actions valuable to the platform, such as completing profile information or engaging with content.

Understanding the Influence of Relativity in Rapidly Changing Economies

As the volatile winds of our economy continue to blow, navigating the pricing seas requires a seasoned captain's eye for relativity. The traditional methods of relative pricing might not stand strong in the storm, requiring businesses to set sails towards more innovative applications, such as progressive time-relative pricing.

One such approach is the "Pay-As-You-Grow" model, a flexible pricing strategy that charges customers based on their usage over time. As customers derive more value from the product, their payments gradually increase. This strategy is particularly effective in SaaS platforms like AWS, which allows customers to start small, pay relatively less at the onset, and scale their payments as their usage increases. This model not only makes the initial entry price seem affordable but also provides a perceived sense of fairness as customers pay proportionately for their usage.

Another approach is the "Decreasing Time Pricing" model. Rather than offering discounts for longer-term commitments upfront, this model decreases the price over time as the customer stays subscribed to the service. The longer customers stay, the less they pay per month. This strategy, relatively new and unique in the market, effectively combines the principles of relativity and loyalty, providing an incentive for customers to stay on board for longer durations.

For instance, a streaming service could initially charge $10 per month, but for subscribers who stay beyond six months, the cost could reduce to $9, and after a year, it might fall to $8. This model provides customers with a sense of gaining more value over time and rewards customer loyalty with relatively lower prices.

Relativity is a compass that can help businesses and consumers chart a path through our turbulent economic seas. By viewing pricing through a time-relative lens, businesses can create innovative strategies that not only appeal to consumers' perceptions of value but also drive consumer loyalty and sustainable revenue growth in these unpredictable times.

Utilizing the Effect of Expectations in D2C Brands

In the burgeoning landscape of D2C brands, where competition is fierce and customer loyalty is as fleeting as a sandcastle before a wave, aligning price, perceived quality, and actual value are crucial. Brands could use counterintuitive strategies to manipulate consumer expectations positively.

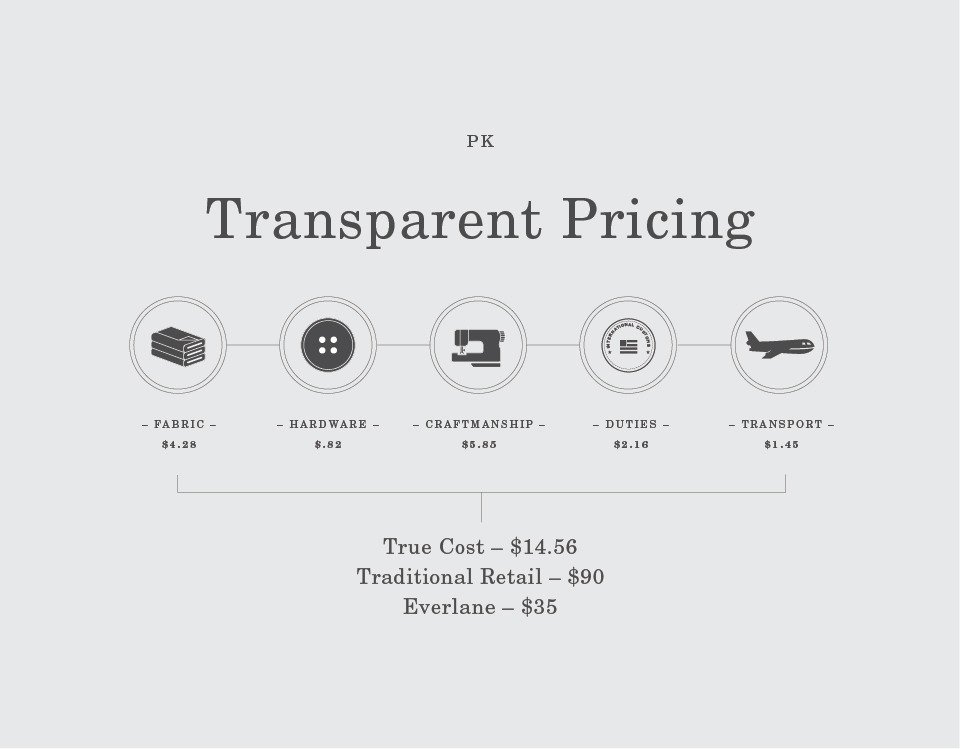

One such strategy involves transparency. Brands could 'open the curtain' to reveal behind-the-scenes production or sourcing costs. This unorthodox approach not only justifies the price to the consumers but also sets their expectations regarding the quality of the product. Everlane, a D2C clothing brand, has successfully implemented this strategy, breaking down costs for consumers and showcasing the high-quality manufacturing processes they employ.

Furthermore, brands can leverage the power of storytelling to set expectations. By creating a compelling narrative around their product - the origins of its ingredients, the people behind it, or the reason it was created - they can build an emotional connection with consumers that transcends price and quality comparisons.

Conclusion

Each economic downturn, market fluctuation, or new tech disruption reshapes our labyrinth, but the threads Ariely presents in "Predictably Irrational" remain consistently reliable guides. They not only provide us with a path forward but equip us with the tools to redraw our map as the landscape changes.

The 'free' model can still work, but it must be redesigned to drive growth without compromising profitability. Relativity still influences decisions, but businesses must become increasingly innovative in creating favourable comparisons. Expectations continue to shape perceptions, but D2C brands, in particular, can turn to transparency and storytelling to align these expectations with reality.

In an economy as uncertain as ours, leveraging our understanding of irrational behaviour might be the most rational strategy we have. It's not about eliminating the maze but learning how to navigate it better. It's about finding order in the chaos, predictability in the irrational, and opportunity in the face of volatility.

Want to share your thoughts? Feel free to share them in the comments section below or on social media.